SME IPOs Fail to Impress: Who’ll Rescue the Global Economy?

SME IPOs disappoint in 2025, even though it’s a great year for India’s startup environment. Recent listings such as Patil Automation and Samay Project Services have also seen subdued investor interest reflecting the change in sentiment.

And this cooling off has been no flash in the pan – it reflects some deeper issues surrounding valuation, transparency and longevity in the SME space.

Why SME IPOs Fail to Impress in 2025

1. Overvaluation and Limited Financial Transparency

Aggressive pricing is one of the most commonly cited reasons for a bad performance of SME IPOs. Many are overvalued without the underlying financials to support such levels. Investors — both retail and institutional — are becoming more jaded about companies that promise the moon and could not pull the numbers together to back their work.

- High p/es and no net income or inconsistent earnings

- Limited disclosure in financial statements

- Revenues and scale are fuzzy or ill-defined

- This is a poor look and doesn’t encourage long-term capital.

2. Economic headwinds and risk aversion

There are the following macroeconomic conditions in 2025:

- Rising interest rates

- Persistent inflation

- Global geopolitical tensions

These have investors seeking the safety of more liquid securities. IN such an environment, it’s no surprise that SME IPOs fail to impress risk-averse investors.

3. Liquidity Squeeze in the SME Space

SME IPOs, unlike mainboard IPOs, frequently experience poor post-listing liquidity. This limits the ability of investors to sell positions, particularly in other than in fair market conditions.

- Wider bid-ask spreads

- Lower trading volumes

- Limited institutional participation

This illiquidity deters both short-term traders and long-term investors who want the freedom of action another reason why SME IPOs fail to impress in 2025.

Case Studies: Why These SME IPOs Did Not Make The Cut

Patil Automation IPO:

The Pune-based industrial automation firm, Patil Automation came with high expectation into a market. Its product line was avant-garde, but the I.P.O. never got running.

Key concerns:

- Limited historical performance

- Unclear scalability roadmap

- High valuation relative to peers

Its fundamentals didn’t justify the price tag, despite the promising sector highlighting how SME IPOs fail to impress when valuations outpace performance.

Samay Project Services IPO

Samay Project introduced in the infrastructure space also did little to excite investors.

Investor concerns included:

- Lack of brand recognition

- Weak financial disclosures

- No clear long-term growth strategy

Both I.P.O.s are cautionary tales: even in red-hot areas of the market, fundamentals matter.

What Market Strategists Are Saying

SME IPO market not broken, just coming of age The SME IPO market isn’t broken—it’s growing up, say top analysts. Investors are getting picky, and that’s healthy In fact, this is one reason SME IPOs fail to impress unless they meet higher standards of transparency and profitability.

Expert Recommendations:

- ✅ Avoid hype-driven listings

- ✅ Look for companies that have proven revenue and profit potential.

- ✅ Review peers in the same industry

- ✅ Go through the Draft Red Herring Prospectus (DRHP) well

“Innovation and unprofitability do not attract long-term investors,” says Rakesh Malhotra, a veteran IPO strategist.

So What Are Retail Investors to Do Now?

🧐 Stay Alert, Not Afraid

The slowdown in small-cap IPO excitement is not a case of life support — it’s a correction. This is a good opportunity for retail investors to practice and develop their own research skills especially in a market where SME IPOs fail to impress due to hype and weak fundamentals.

Pre-investment checklist of an SME IPO:

- Read the DRHP carefully

- Understand the core business model

- Review promoter background and financials

- Evaluate sector trends and peer performance

Diversify Your Portfolio

Don’t count on the I.P.O. though. A well-diversified portfolio across:

- Equities

- Debt instruments

- Mutual funds

- ETFs

…can reduce risk and lead to more consistent returns.

Opportunities Ahead Even as SME IPOs Disappoint.

The mood is definitely mixed at the moment. Even though SME IPOs fail to impress in the short term, it’s providing some interesting opportunities for astute investors. With the fanfare now cooled off, valuations are coming back down to earth — which is often exactly when it’s worth considering some of the diamonds in the rough.

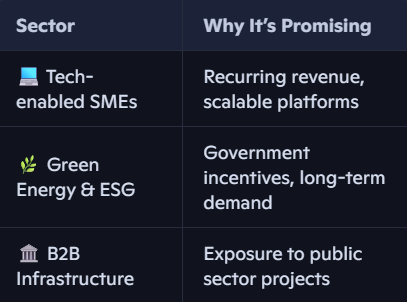

Promising SME Segments to Watch:

These are industries that stand to gain from policy tailwinds and enduring structural demand.

🧭 After a thought about it: A correction, not an implosion

That small company IPOs aren’t happening this way at the start of 2025 isn’t a sign of systemic failure That SME IPOs fail to impress at the start of 2025 isn’t a sign of systemic failure — it’s an organically sound market correction. It underscores the importance of:

- Transparency

- Profitability

- Investor trust

Startups, the message is clear: hype isn’t going to save you. The lesson is equally relevant for investors as well: patience and research are your two best friends.

What Lies Ahead for SME IPOs?

It may feel like a step back: the lacklustre peformance of SME IPOs in early 2025 is a strategic inflection point. As the market grows up, so too are companies and investors. The time of speculative bets built on buzzwords and inflated projections is ending. Instead, a more traditional, fundamentals-oriented approach is taking shape.

For Companies: Reconsider the IPO Playbook

Start-ups and small and medium-sized enterprises aiming to list will now have to re-work their plans. Riding the tide of sectoral trends or bandying about words like “AI-powered” or “disruptive” no longer cut it. Investors are demanding:

- Clear revenue models

- Sustainable margins

- Transparent governance

- Post-IPO growth plans

Those companies that can show these attributes are likely to not only attract capital but establish lasting credibility in the public markets.

Investor: A smarter way to play the SME game

Both retail and institutional investors need to think of this as a weeding process. The market is taking out the weak contenders, leaving the businesses that have some real potential. This is the perfect time to:

- Build watchlists of promising SMEs

- Track quarterly performance post-listing

- Do value investing than momentum chasing

There continue to be huge opportunities in the SME segment, particularly in sectors that are closely aligned with India’s long-term growth story — for instance renewable energy, logistics, digital infrastructure, and AgriTech.

Final Word: From Caution and Concern to Confidence

The 2025 drop in SME IPO enthusiasm is not a crisis — it’s a much needed course correction. It’s a lesson that capital markets reward clarity, consistency and credibility. For investors, it is an opportunity to fine-tune their playbook. For businesses, it’s a wake-up call to stick to fundamentals.

In the long term this will result in a healthier more robust SME ecosystem and one where innovation and integrity are paid.

So while the headlines may shout “SME IPOs Fail to Impress,” the true tale is one of transformation. So while the headlines may shout “SME IPOs fail to impress,” the true tale is one of transformation—and opportunity for those who do the work.

Key Takeaways

- Retail investors need to concentrate on due diligence and diversification.

- SME IPOs are not doing well because of overvaluation, uncertainty about the economy, and liquidity concerns.

- Investors are getting more choosy, with a preference for fundamentals over hype.

- There are still tech, ESG and infra-focused SMEs that offer exciting potential.

- A correction and not a collapse: This is what’s happening in the SME IPO market.

- Want more insights like this? Sign up to Globe Finance Hub for weekly Roundups on IPOs & Markets Analysis and for more Smart Investing ideas.

Investor Q&A: Insights You Need to Know

Q1: What is one of the main reasons SME IPOs are Underperforming in 2025?

Answer: Aggressive valuations with weak financial underpinnings.

Q2: Why are macroeconomic factors making investors bearish on SME IPOs?

Answer: High interest rates and inflation fears.

Q3: Why is liquidity an issue in SME?

Answer: Low trading volumes and wide bid-ask spreads make SME IPOs illiquid, which is a key reason SME IPOs fail to impress in 2025.

Q4: What was concerning with Patil Automation IPO?

Answer:The concern about the scalability and historical performance.

Q5: What are the expert views on SME IPOs for retail investors?

Answer: Stay away from speculation-listed companies, and instead look for fundamentals.

🌐 External Link

- No more retail participation in SME IPOs – Z-Connect by Zerada

- SME IPOs faltering under regulatory scrutiny, but the pain may be worth it – The Economic Times

- Inside India’s SME IPO boom—and why it’s getting riskier

Pingback: Berkshire Plunge Sparks Panic: Buffett’s Magic Losing Its Power?