INTRODUCTION THE RISE OF PEER-TO-PEER LENDING

Traditional banks are no longer the only alternative for lenders and investors in today’s rapidly changing financial market. Peer-to-peer lending websites have revolutionised financial systems by bringing borrowers and the lenders together directly without banks or financial dealers as middlemen. But that brings up an important question: Is your money secured in peer-to-peer lending?

This blog post will detail how peer-to-peer lending works, the pros and cons, and if it is a safe option for a financial decision. We’ll also consider how it stacks up against other financial options and what financial planners think.

What Is Peer-to-Peer Lending?

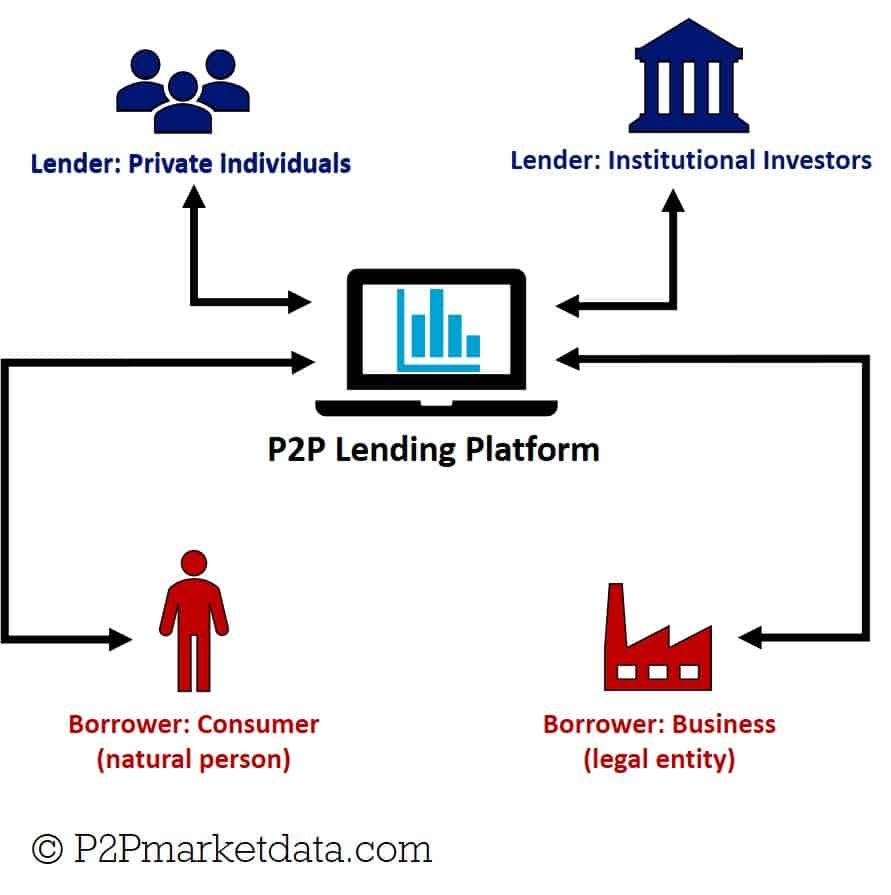

Peer-to-peer lending is an alternative to traditional ways of financing, and has people lending money directly to other people or to businesses using the online platform. Sites like Lendable Loans, Neo Financial and Ally Financial link borrowers and lenders directly, cutting out traditional banks.

It all comes down to the simplicity and the promise of greater returns. peer-to-peer lending gives lenders more earning potential than its alternatives, savings accounts, can offer. Borrowers view it as a faster way to get financing when typically sources are ruled out. peer-to-peer lending gives investors exposure to debt markets not served by the banks, financial advisers say.

peer-to-peer lending isn’t simply personal loans, but also includes business financing, medical loans, education loans and auto loans. Can be industry-specific: Some platforms are dedicated to specific industries, providing a focused menu of investment opportunities to the public. For instance, gold loan is the space of Muthoot Finance, and small business borrowers are supported by Equitas Small Finance Bank.

Is Peer-to-Peer Lending Safe?

The safety of P2P lending depends on various factors, such as the platform’s diligence, the borrower’s creditworthiness, and loan diversification. Unlike banks, there is no federal insurance to protect your money. If a borrower defaults, the investor suffers the loss. This risk distinguishes it from savings accounts and fixed deposits.

Financial planners say to pick reputable platforms with solid track records. Diversification in the form of dozens or hundreds of loans can reduce total risk. Something like Yahoo Finance Portfolio or Google Finance Portfolio can help you track and analyze returns.

Reinvesting profits is another strategy in order to reduce risk. Many platforms also offer to automatically reinvest the interest, potentially multiplying returns over time. But it also raises your exposure.

The Financial Advisor’s Role in P2P Decisions

If that all sounds too complicated for you, a financial adviser or chartered financial analyst can guide you through the world of peer-to-peer lending. They evaluate your risk tolerance, and can help decide what percentage of your portfolio should go toward P2P loans. Some experts advise that you make this no more than 10% of your investments.

Financial planners also look at where peer-to-peer lending fits within your financial plan in relation to retirement or buying investment properties or starting up a business. These are the pieces that analyze risk, liquidity and returns within your holistic money management strategy.

Advisors may also work towards developing alternate strategies in case of a down market. For example, should recession strike and default rates rise, your advisor could move your money into safer assets such as government bonds, or diversified mutual funds.

Key Risks in Peer-to-Peer Lending

- Credit Risk: Borrowers can fail — and there’s no government insurance through FDIC.

- Platform Risk: In case the P2P platform commits a mistake because of bad management, they might lose your money.

- Liquidity Risk: You can’t just sell a P2P loan before it reaches maturity as you can with stocks like SPDR or NVDA.

- Financial Risk: The current financial market is volatile. A weak economy can also contribute to higher rates of default.

- Interest Rate Risk – Changes in SOFR or the interest rates charged by banks could impact the relative attractiveness ofP2P loans with a fixed interest rate.

- Fraud Risk: In unregulated markets, scammers can set up exchanges to attract unwary users. Research is a factor.

- Currency Risk: If you’re investing outside your home market, fluctuations in exchange rates can affect returns.

Private Credit vs. P2P Lending

Private credit, held by institutional investors, is larger and more secure than peer to peer lending. Both are nonbank, but private credit tends to have more structure and can have a bank guarantee or be collateralized.

peer-to-peer lending is more open to individual investors, however. Hybrid models, which include the likes of L&T Finance or IIFL Finance, both P2P elements and institutional backing. For instance, IIFL and Bajaj Finance show investor confidence in hybrid lending models.

Private credit encompasses mezzanine loans, syndicated loans and asset-backed lending to larger, less documentation-efficient borrowers. P2P loans are about simplicity and speed.

Popular P2P Lending Platforms and How They Work

- Lendable Loans: Offers personal loans, funded by retail and institutional investors, fast and user friendly.

- Neo Financial: Combines banking with investment products, like lending options.

- Ally Financial: This is mostly a bank, but it has peer-lending-type products.

Every platform has unique products and risk profiles. It is important to understand how their business models work, and how they assess borrower risks before investing.

Some of the platforms have secondary markets where you can sell those performing loans to other investors, providing some liquidity. Others offer auto-investment features that invest your money based on preset risk tolerances.

Reading Financial Reports and Technical Trends

Analyze the financials of these platforms before investing. Are they profitable? Are the rates of default going up or down? Use services such as Yahoo Finance Stocks, MSN Money, and others to monitor stock trends.

Some even use quantitative trading and mathematical models to predict what will happen. Although they seem convoluted, these methods assist in the analysis of stocks such as Bajaj Finance or IRFC. You can use leveraged finance if you understand the risks and the opportunities present in using debt to enhance returns.

P2P Lending and Sustainable Finance

Sustainable finance has been adopted by many platforms. Loans may involve green energy projects or community development. If impact investing falls in line with your approach, ask your financial advisor to consider platforms centered on social impact.

Traditional and sustainable investors can bring the two together, leveraging P2P lending both for returns and for positive change. The platforms that have tied up with Tata Capital or LIC Housing Finance are also driving responsible lending and sustainability.

Websites that are ESG (Environmental, Social, Governance) compliant can appeal to socially-minded investors. This trend signifies that P2P lending is not all about returns, but also about social where you make an impact!

Alternative Investment Comparisons

When we compare it to mutual funds, ETFs like QQQ, or individual stocks (Tesla, anyone?) it really starts to shine. It provides fixed returns on monthly basis however is not liquid and scalable.

But it can balance with other investments under the guidance of a financial adviser, particularly in today’s turbulent financial markets. According to MSN Money and Yahoo Finance data, market fluctuations often push investors toward steady private investments.

The analogy to real estate is apt. It can be said, that the mortgage for investment property does have a collateral; however there are also repairs, legal and market pressure as well issues. P2P lending is devoid of tangible value such as property, but not of these liabilities.

Gold, cryptocurrencies and hedge funds are other options, all with their own risk-return profiles. In a diversified portfolio P2P lending plays the role of fixed interest, an income generator with medium risk.

Advanced Strategies for Secured Lending

- Spread your dollar investments broadly throughout loans, and the kinds of borrowers to whom they are made.

- Keep it simple and scale it only if it’s working.

- Leverage analytics tools, like Google Finance and Yahoo Finance.

- See a financial advisor about a comprehensive review.

- Watch SOFR rates and the market overall.

- Invest in tranches, and stagger loan maturities.

- Utilize platforms with auto-diversification features.

- Look through borrower ratings, and be wary of high-risk groups unless the returns warrant the risk.

- Create alerts with Yahoo Stock Quotes and keep an eye on platform news.

- Consider net annualized return rather than gross return.

- Monitor the performance of track-specific sectors, especially when there is economic turmoil.

- Read through platform’s whitepapers and annual reports to remain informed.

Regulatory Environment and NBFCs

(For example in India NBFCs like Muthoot Finance or IndiaBulls housing finance act similarly to P2P lending platforms). These companies are more heavily regulated than average P2P lending platforms and provide some safety.

The Reserve Bank of India (RBI) has issued regulations governing P2P lending and so business partners have stared to adhere the regulations which include exposure limits, registration, operational details etc. Similarly, NBFCs like Mahindra Finance and Equitas Small Finance Bank follow regulations with capital adequacy requirements and risk assessment rules.

Financial Engineering and Innovation in Lending

In the same way that quantitative trading influenced the stock market, now these machines are lending, impacting the perception of investors’ in platforms like Equitas Small Finance Bank and Tata Capital.

Just as quantitative trading changed stock markets, these techniques are now applied to lending, altering the way investors perceive platforms like Equitas Small Finance Bank and Tata Capital.

The P2P lending platforms are adopting blockchain technology as it provides more transparency and tracking. Smart contracts might supplant the sort of “dumb” agreements between parties that can’t settle their differences, leading to delay and legal messiness.

And peer-to-peer (P2P) lending is itself evolving with the tokenisation of individual sections of loans on a blockchain to allow fractional ownership and the creation of secondary markets.

Is P2P Lending for Everyone?

No. If you are a conservative investor or anyone else that just likes the safety and security of familiar markets, peer-to-peer lending is not your thing. But for others, the rewards are simply not worth the risk without the proper considerations.

With features such as Yahoo Finance US, financial statement analysis, and IA Financial, available tools will ensure you can make informed decisions. It’s worth talking to a financial planner so you can be sure these long-term investments will work for you.

Before you dive in, take into account your risk tolerance, stability of income, as well as, your personal level of financial education. It’s not suitable for everyone.

Professional Opinions: What Financial Planners Have to Say

Most certified planners also agree that peer-to-peer lending is a great diversification play, but not a foundational investment. They recommend balancing it with traditional investments and watching out for signs such as Bajaj Finance Share Price or IRFC Share Price Today.

They also warn against “over-diversifying,” or spreading your money too broadly across too many peer-to-peer lending platforms. Choose a few, check them once a day and watch as reports come in from sites like Yahoo US Finance or MSN Money. Compare returns to bonds or equity mutual funds for a complete risk-return view.

The majority of advisors stress the need for well-kept records and tax reporting. As with most peer-to-peer lending, returns are taxed as income, hence the need for ongoing monitoring and reporting to avoid penalties.

Case Studies and Success Stories

A hypothetical example would be an investor who invested 5% of their profile in Peer-To-Peer lending in a diversified service. They managed an annual 9% return after three years, far above their bank fixed deposits. Yet another used AI-based tools on a platform that is associated with Bajaj Finserv, and experienced steady returns with minimal defaults.

However, some investors have lost money by choosing platforms with poor underwriting standards. This highlights the importance of thorough research, cost analysis, and trusting expert advice.

Conclusion: Should You Invest in Peer-to-Peer Lending?

Peer-to-peer lending can be an effective money management strategy if approached with caution. It presents an exciting opportunity in modern finance with potential, accessibility, and high returns, but it is not risk-free.

Peer-to-peer lending can be a smart money strategy if handled wisely.

DO:

- Seek expert guidance

- Track financial markets

- Use structured analysis

- Invest what you can afford to lose

- Monitor performance like stocks

- Know tax rules

- Learn daily from Yahoo Finance, MSN, and Financial Samurai

P2P lending isn’t just about returns—it’s about witnessing the future of finance firsthand.

Suggested Links:

Must Read :

- How to Register a Business Anywhere in the World – Step-by-Step Guide

- Need Help with Your Money? Choose the Right Financial Expert

- What is a Financial Advisor and How to Choose the Best One in 2025

- Secure Your Future: 10 Best Investment Strategies for New Investors in 2025

- 6 Global Tech Trends Triggered by Apple’s New AI Update

Pingback: Google Finance vs Yahoo Finance: Best Platform in 2025?