Introduction: Berkshire Plunge Sparks Investor Panic

Berkshire Plunge Sparks Panic recently fell into double-digit territory. Many attribute this decline to the fading of the so-called “Buffett premium.” On June 12, shares dropped to about 10% below their peak on May 2, which stands in stark contrast to the overall market gains during the same time. This upheaval has shaken investor confidence and made analysts and retail traders doubt whether Berkshire Hathaway can maintain its status as an elite investment once Warren Buffett steps down.

What Is the Buffett Premium—and Why Has It Disappeared?

The Buffett Premium Explained

For decades, Berkshire Hathaway traded above its book value and earnings multiples. This premium reflected the immense trust investors placed in Warren Buffett’s leadership. From 1965 to 2023, Berkshire generated nearly 20% annualized returns, far surpassing the S&P 500.

By mid-2024, shares traded at a 60-80% premium to book value. That figure has now dropped to about 1.6 times book value, down from nearly 1.8 times on May 2.

What Triggered the Decline?

Several factors combined to erase the Buffett premium:

- Leadership Succession: Buffett’s announcement at the May 3 annual meeting that he will step down as CEO at year-end, with Greg Abel taking his place, unsettled investors.

- High Cash Reserves: Berkshire’s record cash pile of around $348 billion and lower expectations for interest income have pressured the valuation.

- Insurance Cycle Fears: Worries about a potentially peaking insurance underwriting cycle have also affected market sentiment.

- Muted Capital Deployment: Berkshire has been a net seller of stocks for 10 straight quarters, leading to raised eyebrows.

Consequently, Berkshire shares fell even as the broader S&P 500 rallied by about 6% since early May.

Berkshire Plunge Sparks Panic Stock Drops Double-Digits: What the Numbers Say

A Correction in a Rising Market

By June 12, Berkshire Plunge Sparks Panic entered a correction with at least a 10% drop. Class A shares hit lows near $728,415, down from a peak of $809,350. Meanwhile, the S&P 500 continued to advance, making this divergence noteworthy.

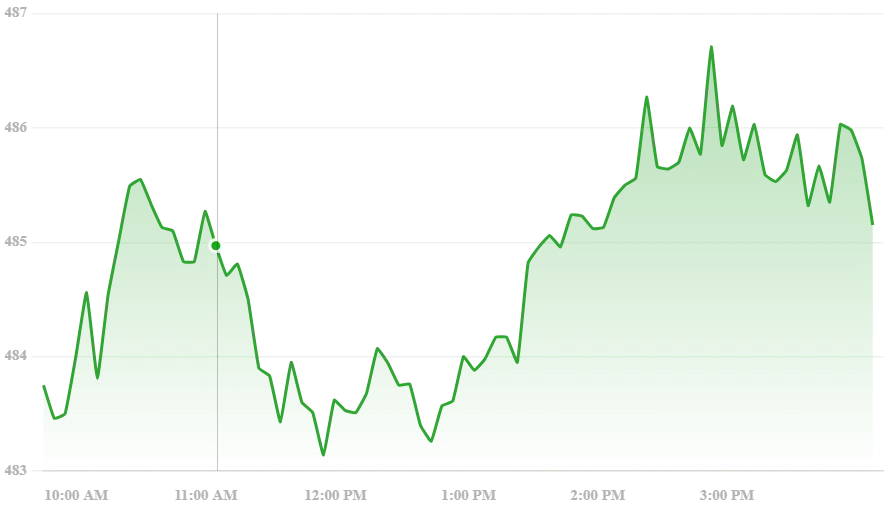

Market Reaction Snapshot

Class A shares: Down about 10% recently.

Class B shares: Priced around $487, reflecting the same depth of correction.

Valuation now: About 1.6 times book value, compared to a recent average of around 1.5 times.

P/E ratio: Roughly 24 times forward earnings, higher than the S&P’s approximately 22 times.

Analyst Revisions

UBS’s Brian Meredith cut earnings forecasts by 6% for 2025 and 1% for 2026, citing weaker investment and insurance dynamics.

Morningstar noted that while the Buffett premium is diminishing, Berkshire still holds a premium floor, supported by its cash and buyback flexibility.

Buffett’s Magic Losing Its Power? Leadership Transition Under Scrutiny

Succession Implemented, Not Abrupt

After Berkshire Plunge Sparks Panic, Buffett will continue as chairman and maintains a significant equity and voting stake of about 14% of shares and roughly 30% voting power. Greg Abel has managed non-insurance operations since 2018 and was named Buffett’s successor in 2021.

What Omaha Shareholders Think

At the 2025 annual meeting, mixed feelings were evident. Many feared losing Buffett’s charisma and connection to Omaha, but several investors expressed their intent to hold or even buy more shares, trusting the transition plan.

Market Confidence in the New Team

MarketWatch pointed out that investors still trust Greg Abel’s leadership. The 5% drop following the succession news was seen as modest, indicating a smooth and well-communicated transition.

Berkshire’s Cash Pile and Strategic Choices

Record Cash Hoard: Blessing or Burden?

With around $348 billion in liquid assets, including cash, equivalents, and Treasuries, Berkshire enjoys unmatched strategic flexibility.

Yet investors are concerned. Berkshire has net-sold equities for more than two years, accumulating cash while allowing valuations to cool.

Buybacks Returning?

In the past, Berkshire has repurchased its stock when valuations were favorable, spending $78 billion between 2018 and 2024. The current lower 1.6 times book value might prompt renewed buybacks under Buffett’s direction.

However, the recent selloff has not diminished the premium enough for Buffett, who has paused share repurchases for months.

Retail Investor Sentiment: Reddit Reactions

Here’s a glimpse of investor sentiment on Reddit after the roughly 10% drop:

“With Buffett gone, it’s probably overvalued by 10%. It is a slightly safer play than SPY if we have a sudden drop.”

“Algorithms trading on sentiment… I sold. BRK has been one of my largest positions… valuation driven.”

Some view the plunge as a buying opportunity. Others remain cautious, citing valuation risk without Buffett’s guidance. A tone of uncertainty prevails among long-term retail holders.

Is Berkshire Still a Buy? Assessing Pros and Cons

✅ Bullish Arguments: Berkshire Still Has Value

- Transition in Place: Greg Abel and Ajit Jain are seasoned successors chosen by Buffett.

- Strong Asset Base: Diversified businesses in insurance, railways, energy, and manufacturing continue to generate cash.

- Potential Buyback Catalyst: Post-dip price levels could lead to new share repurchases.

- Strategic Patience: Buffett’s value approach may benefit if markets return to attractive valuations.

⚠️ Bearish Arguments: Buffett’s Magic Fading

- Valuation Remains High: Berkshire Plunge Sparks Panic. After the correction, the stock trades at about 24 times earnings and 1.6 times book value.

- Dormant Cash Deployment: Berkshire’s $348 billion cash is sitting idle, representing potential opportunity cost in a market downturn.

- Insurance Cycle Vulnerability: Weaker underwriting margins could impact profitability.

- Succession Maturity: Greg Abel, while capable, lacks the broad appeal and market reassurance that Buffett provides.

Key Takeaways: Where to Go From Here

Short-Term Outlook

Market sentiment remains fragile, as evidenced by ongoing declines despite positive macro trends. Watch for share buyback announcements—any move may signal that management views the current price as undervalued.

Medium-Term Outlook

The success of Greg Abel’s transition, particularly how he utilizes the cash reserves and reallocates capital, will significantly affect Berkshire’s valuation. Keeping an eye on earnings and insurance-cycle metrics is essential, as underperformance may extend the discount.

Long-Term Outlook

Berkshire’s diverse structure and solid cash flow continue to support its long-term viability. Buffett’s legacy strategies—patient investing, careful acquisitions, and opportunistic buys—should still guide the firm under new leadership.

Berkshire Plunge Sparks Reflection: Is Buffett’s Magic Really Fading?

The decline raises important questions: Is Berkshire still special without Buffett? Will shareholder returns decline under new leadership? The answers remain debated.

- If the drop is merely a reset of valuations, and Abel successfully implements strategies and activates buybacks, Berkshire’s long-term case may stay strong. However, if succession struggles or capital deployment falters, Berkshire might lose its investment appeal.

- In either case, the $348 billion cash reserve, diverse operations, and value-driven philosophy provide a solid foundation.

Final Thoughts: Should You Consider Buying the Dip?

For cautious investors, a tiered approach may be wise: start with a partial position and increase it if share buybacks happen or if valuations drop further. Risk-tolerant investors who believe in Berkshire’s continuity might see this as a rare chance to secure a historically strong conglomerate at a more attractive price.

📘 Related Insight: Explore our Dynamic Capital IPO analysis to see how investor sentiment is shifting across markets.

🌐 Further Reading: Read Buffett’s annual letters for deeper insight into Berkshire Hathaway’s strategy.

🛒 Must-Have Guide: Ready to master the market? Get your copy of the Trading Mastermind Book – Become a Trading Expert From Scratch and start your trading journey today!

Pingback: World on Edge Iran Strike Plans Rising