You’re a founder building a company with global aspirations. You know you’ll want to limit your liability, but as you examine your options, you’re bombarded with acronyms: LLC, Ltd, PLC, S Corp. … What do they all mean? This guide breaks down the differences between a limited liability company vs. limited company

🧭 Golden Rule (unavoidable, upfront):

👉 An LLC (Limited Liability Company) is an U.S. incorporated entity.

👉 A Ltd (Private Limited Company) is the type used in the U.K. and Commonwealth.

Both serve similar purposes — but are legally and operationally different.

This guide pieces apart the most notable—liability, taxes, governance, compliance, use cases—making it easier to make an informed decision for your international venture.

.

✅ Disclaimer

Disclaimer: This guide if for educational and informational purposes only. It is not a replacement or substitute for professional legal or tax advice. The creation of an international entity is complicated and has substantial legal and fiscal consequences. As always, you should seek the advice of competent counsel and accountants in the relevant jurisdiction.

US, What is an LLC (Limited Liability Company)?

Key Points

- Territory: U.S. only

- Legal Form: A hybrid of corporation providing limited liability but taxed as a partnership!

- ✅ Liability

- Members are shielded and aren’t personally on the hook for the company’s debts or lawsuits.

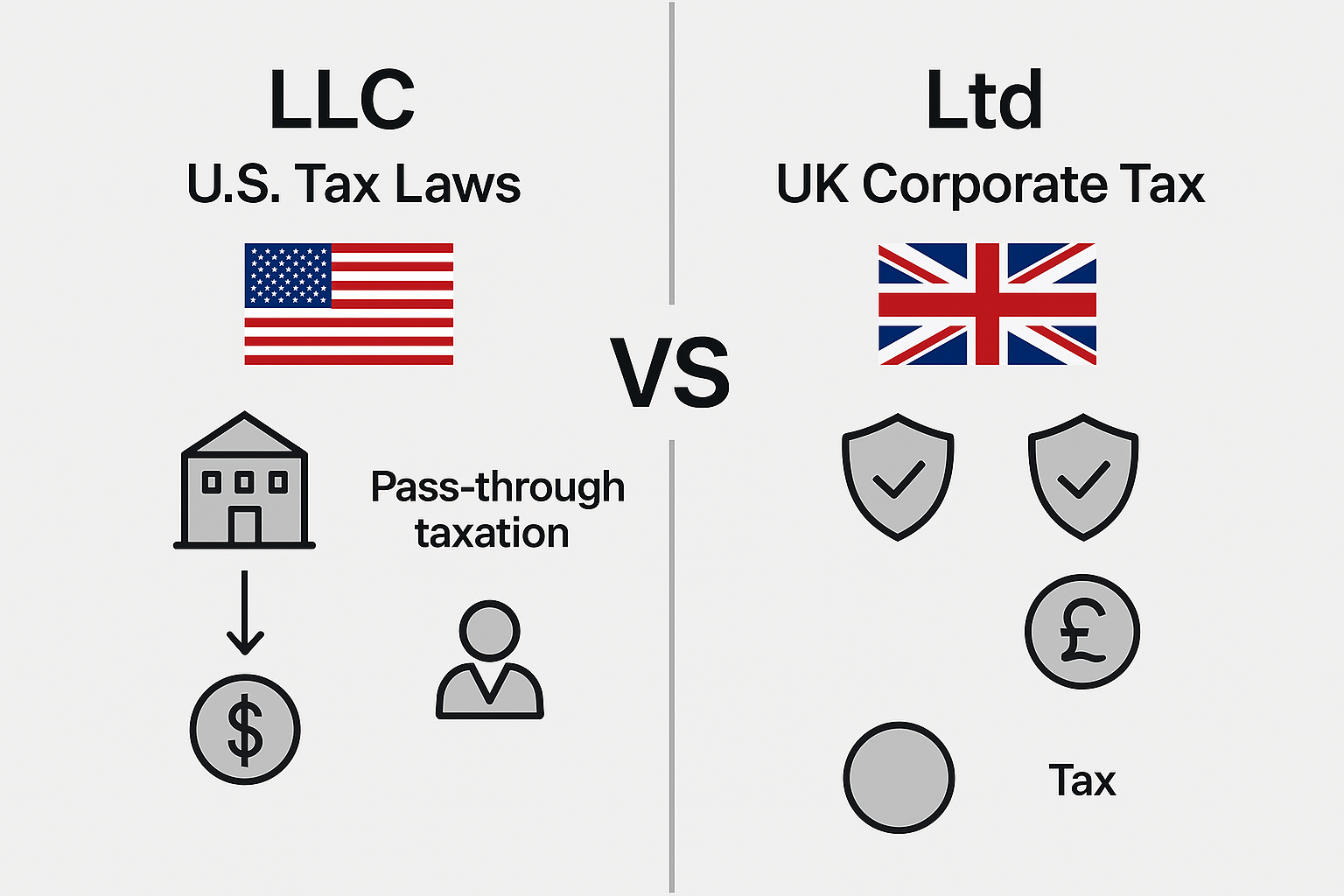

🔁 Taxation

All profits/losses pass-through to members personal tax returns by default—no corporate-level tax—unless work as a corporation.

⚙️ Management

- Member-managed: The members themselves manage the business.

- Manager-managed: Members appoint managers

Internal control of its contractual structure is provided by an Operating Agreement.

🧩 Use Case

Perfect for US early-stage small to mid-size startups, consultancies and small businesses looking for both protection as well as flexibility.

📚 Setting One Up

LLC filing is clear as mud. You come up with a unique name, file Articles of Organization, name a Registered Agent, and write an Operating Agreement. Guidance and costs vary by state

This section compares key features of a limited liability company vs. limited company to help global founders navigate U.S. incorporation

🇬🇧 What is a Private Limited Company (Ltd)?

Key Points

- Territory: U.K., Ireland, India, Australia, Canada, New Zealand, and all other Commonwealth countries

- Legal Form: As a full-bodied corporation with legal status and governance.

- ✅ Liability

Shareholders are not responsible beyond the amount of their shares.

💷 Taxation

Pays Corporation Tax on its profits (e.g. 25% in the U.K.). And the cash is returned to shareholders as dividends, which carries a dividend tax burden for shareholders.

👨⚖️ Governance

- Must have a Director and Shareholder as a minimum position

- Controlled by Articles of Association filed publicly at Companies House

🧩 Use Case

Growth Cap is ideally suited for post-revenue startups, particularly those that are fundraising from UK, EU or global investors

Understanding the limited liability company vs. limited company structure can clarify how Ltds operate in Commonwealth regions.

🔗 How to Start an LLC in the U.S.

🔍 Side-by-Side Comparison

| Feature | LLC (U.S.) | Ltd (U.K./Commonwealth) |

| Jurisdiction | U.S. states | U.K. & Commonwealth |

| Legal Registration | Articles of Organization | Memorandum & Articles of Association |

| Liability | Shields personal assets | Shields personal assets |

| Governance Structure | Flexible; member- or manager-managed | Formal: roles of directors and shareholders established |

| Tax Structure | Pass-through; personal tax only | Company: pays corporate tax + dividend tax |

| Transparency | Private, internal records | Public filings at Companies House |

| Investor Friendly | More unusual with VC with no conversion | Standard for global VC investments |

This head-to-head breakdown of limited liability company vs. limited company helps founders visualize crucial legal and operational differences.

🧩 Choosing the Right Structure: A Practical Framework

1. Geography & Customer Base

- Primarily U.S.: LLC likely best

- U.K./International: Ltd conforms with local custom and law

2. Fundraising Plans

- Ltd, VC friendly and global spirit.

- LLC may also need to be converted to a U.S. C-Corp during fund raising, with legal and tax steps.

3. Desired Tax Treatment

- Prefer simpler, single-layer tax? Go with an LLC

- Want to keep earnings in the company? A Ltd is permitted to do this until distributions are paid out

4. Growth Trajectory: Delaware Flips

Ambitious companies are likely to commence their life as a U.K. Ltd and then flip into a U.S. Delaware C-Corp to draw in U.S.-based VCs, and offer stock options — but this requires planning and legal advice.

Deciding between a limited liability company vs. limited company depends heavily on your goals, geography, and investor strategy.

🔗 Private Limited Company Registration in the UK

🛠️ Key Compliance & Setup Requirements

For LLCs (U.S.)

- Register through your state → file Articles of Organization

- Hire a Registered Agent to be your official representative

- Write an Operating Agreement (not required in every state, but a good idea)

- After getting the EIN, it can be used for corporate taxes and employee reports.

For Ltds (U.K.)

- File form IN01 and register with Companies House (£50-£71+ fees)

- Draft and submit M&A for registration

- Appoint a minimum of one Director and one Shareholder

- Register for Corporation Tax, and VAT if required

- File annual confirmations, reports, and statements

- Keep a Registered Office and be a member of Companies House

Compliance steps vary widely in the limited liability company vs. limited company debate—here’s how to prepare for each jurisdiction.

📈 Recent Trends & 2025 Updates

- In the U.K., upcoming requirements mandate identity verification for directors and Persons of Significant Control (PSC) to combat fraud

- Online formation in both jurisdictions is now faster and more accessible—U.K. Ltds can be registered within 24 hours, and U.S. LLCs can be registered via state portals or kits

New legal trends highlight differences in limited liability company vs. limited company registration and transparency rules.

🧩 Final Takeaway: No Winner—Only the Right Fit

Your structure choice depends on:

- Geographic focus

- Growth strategies

- Tax planning

- Investor preferences

- ➡️ An LLC suits U.S. operations with flexible tax treatment.

- ➡️ An Ltd suits ventures targeting global presence with formal share structures and re-investment opportunities.

- Either way, talk to a cross-border attorney or accountant to navigate the nuances and filings with confidence.

.

Choosing between a limited liability company vs. limited company isn’t about winning—it’s about what fits your global startup strategy.

🔗 Choosing the Right Company Structure

🧾 Call to Action

Want clarity before filing? Consult with an international business attorney and accountant.

Get prepared: Download our free “International Entity Formation Checklist” to ensure you’ve covered all critical steps.

🧑💼 Author Bio & Final Disclaimer

Dr. Priya Ramanathan, JD & ACA, International Business Lawyer at Global Launch Law 12+ years advising founders and companies across the US, UK, EU and India. [LinkedIn] | [GlobalLaunchLaw. com]

Disclaimer: This article is for educational purposes only and does not replace legal, tax, or financial advice. Entity formation can carry significant legal and financial obligations. Please consult qualified advisors in the relevant jurisdictions before proceeding.

🌐 External Links

— IRS: Limited Liability Company Tax Information

— UK Government: Setting Up a Private Limited Company

— Harvard Business Review: How Corporate Structures Influence Startup Success