📚 Table of Contents

- Introduction: Aspora Raises $53 Million

- What is Aspora?

- Why Aspora’s $53M Raise Matters

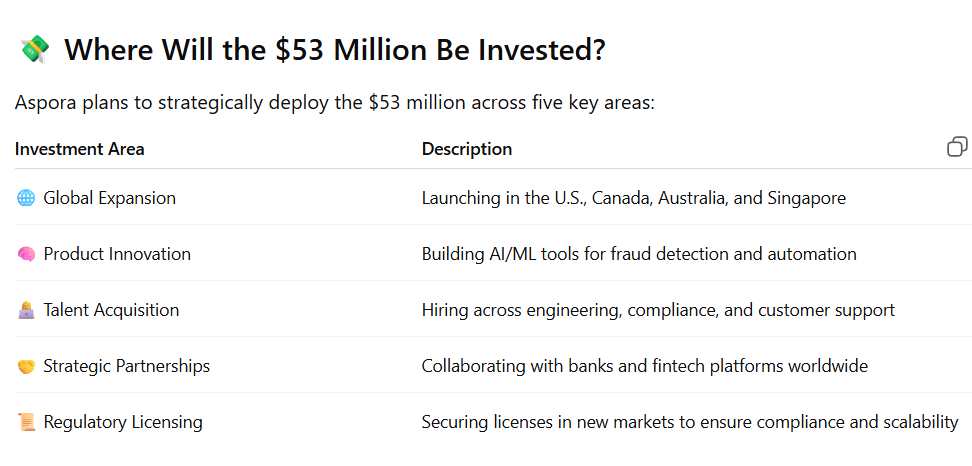

- Where Will the $53 Million Go?

- Investor Confidence in Aspora

- Aspora’s Global Expansion Strategy

- What Makes Aspora Different in Fintech

- What’s Next for Aspora?

- Conclusion: Aspora’s Fintech Future

🏁 Introduction: Aspora Raises $53 Million

Cryptocurrency concerns filled the early years for business leaders attending the World Economic Forum.

Aspora raises $53M in a major Series B co-led by Sequoia Capital and Greylock Partners The move puts the fintech startup at the forefront of global cross-border banking, particularly for the Indian diaspora. With this funding, Aspora is poised to reinvent the way immigrant populations deal with money across borders.

Launched in 2022 by Stanford dropout Parth Garg, Aspora is already making noise with its AI-based remittance platform, zero-fee transfers and Google-matching exchange rates.

This moment, where Aspora raises $53 million, marks a turning point in how fintech platforms serve global communities.

💡 What is Aspora?

Aspora is a London-headquartered fintech startup offering frictionless, safe, and affordable financial services for Global Indians. Formerly known as Vance, Aspora rebranded in 2025 to broaden its mission building a global financial ecosystem for diaspora communities.

It’s no surprise that Aspora raises $53 million to scale its mission of building a global financial ecosystem for the diaspora

🔍 Key Features of Aspora:

- Instant zero fee remittances from UAE

- Google-matching exchange rates

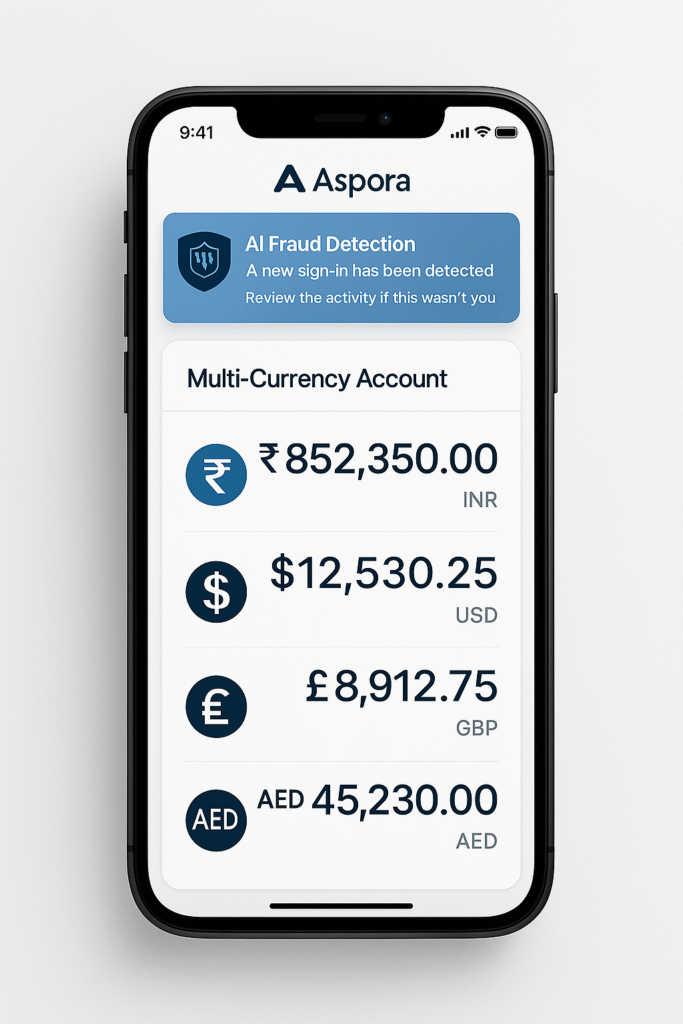

- AI-driven fraud detection

- Developer-friendly APIs for embedded finance

- Multi-currency accounts and investment tools

Now, Aspora has been used by more than 250,000 users and processed more than $2 billion in the transactions.

The fact that Aspora raises $53 million underscores the growing investor appetite for diaspora-first fintech solutions.

There are a few reasons why Aspora raising $53 million is so notable:

- 📈 It’s one of the biggest Series B rounds in the fintech landscape of 2025

- 🌐 Validates the appetite for diaspora-centric financial infrastructure

- 💼 Spotlights move toward embedded finance and cross-border APIs

- 🏆 Puts Aspora in the same tier as Stripe, Wise and Revolut

The round brings Aspora’s total funds raised to $99 million, and its valuation to $500 million.[final]

💬 Investor Confidence in Aspora

With such high-profile backers, it’s clear why Aspora raises $53 million to fuel its next phase of growth.

Luciana Lixandru, a partner at Sequoia Capital, added:

“Aspora is dragging diaspora banking into the contemporary era. “It’s not just about digital banking — it’s about unlocking financial opportunity for millions living in other countries.”

Other notable investors include:

- Balaji Srinivasan (Former CTO, Coinbase)

- Sundeep Jain (Former CPO, Uber)

- Chad West (Previously Director of Marketing, Revolut)

These are strong votes of confidence in Aspora’s vision and execution3.

🌐 Aspora’s Global Expansion Strategy

After Aspora raises $53 million, the company is accelerating its expansion into key diaspora markets.

Aspora’s roadmap for expansion includes roll-outs in:

- 🇺🇸 United States

- 🇨🇦 Canada

- 🇦🇺 Australia

- 🇸🇬 Singapore

- 🇩🇪 Germany

IMPROVEMENTS TO THE STATUS QUO

With active operations in the UK, UAE, and EU Aspora is strategically located to serve high density diaspora corridors

🏆 How Aspora Is Changing The Game In Fintech

Aspora is not just another remittance app. It is creating a full-stack financial platform for immigrants and global citizens.

The way Aspora raises $53 million to build this infrastructure shows its commitment to long-term innovation and inclusion.

🚀 Competitive Advantages:

- Zero-fee transfers from the UAE

- Clear-cut pricing, with Google-style exchange rate matching

- Developer tools for fintech integration

- Multi-currency accounts and investment tools

🔮 What’s Next for Aspora?

Booting up with a $53 million round of funding, Aspora aims to:

Launch sandbox environments for developers

Extend its range of APIs for B2B platforms

Serve high-volume enterprise clients

Be the first player in embedded global finance

Aspora’s road map includes creating new credit, insurance, and investment products designed for immigrants

🧾 News of the New None!

The funding round where Aspora raises $53 million will directly support the development of these new financial products.

Aspora’s product platform is created to serve the entire range of financial needs of the immigrant population. Here’s what’s coming next:

1. 💳 Credit Products for NRIs

Specifically, Aspora is creating loan products designed for non-resident Indians (NRIs), such as:

- NRI credit cards that are accepted worldwide

- Cross-border credit scoring models

- Pre-departure credit facilities for students and professionals going abroad

The products are designed to address a long-puzzling problem: Immigrants often can’t get credit in their new homes because of their limited financial history local to their new country.

2. 🏦 Multi-Currency Bank Accounts

Aspora is aiming to roll out interest-bearing multi-curency accounts which will enable:

Maintain balances in INR, USD, GBP,and AED

Receive interest on FCRA deposits

Seamlessly transfer funds between countries

This is an excellent feature, especially for those who earn and spend/invest in different currencies.

3. 🏠 Cross-Border Bill Payments

I met with Aspora in anticipation of the release of a bill payment service which in the future, these are some of the proposed features.

From overseas, paying rent, utilities and credit card bills in India

Schedule recurring payments

Track expenses in real time

This is a game changer for NRIs supporting their family or owning a property back home.

4. 💼 Tools of Wealth for Investments Across the Globe

Aspora is also creating investment vehicles enabling users to:

Not to worry; invest through Indian mutual funds or global ETFs.

Access NRI-specific fixed deposit schemes

Invest across asset classes via AI-based portfolio advisories

Useful in growing wealth across countries while abiding by local regulation, these tools will be evident.

🛡️ Insurance for Families Back Home As for many migrants, the importance of remittances to help families at home is nothing new for these seafarers.

Aspora has one of the most innovative products in its pipeline — cross-border insurance. Features include:

Health insurance for parents in India

Emergency medical coverage

Concierge services for elder care

This product is intended to offer security to immigrants who wish to protect their loved ones.

These offerings are part of the broader vision that Aspora raises $53 million to bring to life for global Indians.

🧭 Aspora’s Long-Term Vision

Aspora isn’t building a fintech app it’s creating the financial operating system for the diaspora. Its long-term goals include:

- 🌐 Being the default financial platform for 100M+ global Indians

- 🏦Launching full-stack NRI bank accounts with instant onboarding

- 📊 Providing a tax optimization tool for cross-border income

- 🤝 Partner with governments and regulators to de-risk and help simplify compliance

Aspora’s motto is “borderless bank,” and Garg describes it that way, too — though the startup understands firsthand the needs of immigrants in a way no traditional bank ever could.

Aspora raises $53 million to realize this vision of a borderless, inclusive financial future.

🧠 Why Aspora’s Strategy Works

Aspora’s winning strategy is its sharp focus on a niche but influential segment – the Indian diaspora. Here’s why this is working:

| Factor | Impact |

|---|---|

| 🎯 Niche Targeting | Decoding NRIs lets players fine-tune products and messages |

| 🌍 Global Presence | London, Dubai, and Bengaluru offices for international growth. |

| 🧠 AI-Driven Innovation | Intelligent anti-fraud tools, credit scoring, and investment advice |

| 💬 Community-Centric Approach | Product built from actual user feedback and diaspora-mandated needs |

📈 Growth Metrics and Milestones

Aspora’s rise has been meteoric to say the least:

- 💵 $2 billion in transactional volume (compared to $400M in 6 months)

- 👥 250,000+ active users

- 💰 15 million the amount in fees of saved for by, users

- 🌍 Presence in 6 countries and growing

These are not just numbers that show product-market fit; they also represent deep user trust.

🧩 Challenges Ahead

Aspora has some momentum behind it, but it faces several obstacles:

- 🏛️ Red tape in new markets

- 🧑💻 Scaling engineering and compliance teams

- 🧠 Teaching users how to use new financial tools

- 💼 Facing well-heeled global rivals

But with deep-pocketed investors behind it and a detailed roadmap, Aspora seems prepared for these headwinds.

🧠 Final reflections: Why You Need to Care About Aspora

Aspora raises $53 million not just to scale—it’s here to lead a movement. In a world where financial systems are still mostly national, Aspora is building something genuinely global. Pushing around money between countries has always been difficult for immigrants. Aspora is solving that, with beauty, smarts and empathy.

Whether you’re an investor, a fintech fan or a member of the diaspora, Aspora’s journey is one to follow. It’s not just a start-up — it’s a sign that the future of finance is borderless.

User Q&A: Aspora

Q1: Why did Aspora raise $53 million?

Answer:

For expansion to the global markets to improve AI driven fintech products and cater the Indian Diaspora better.

Q2: What makes Aspora different from other fintechs?

Answer:

Aspora specializes in diaspora banking along with zero-fee remittances and NRI-specific financial tools.

Q3: Aspora will be releasing some new products?

Answer:

Credit cards, multi-currency accounts, cross-border bill pay, and insurance for the diaspora.

Q4: Who was Aspora’s Series B round led by?

Answer:

Sequoia, Greylock, Balaji Srinivasan and other leading fintech executives participated in the round.

Q5: How is Aspora using AI?

Answer:

For fraud prevention, credit scoring, and personalized financial advice.d

🔗External Links:

1. Sequoia Capital – Aspora Investment News

2. Greylock Partners – Portfolio Companies

3. RBI – Remittance and NRI Banking Guidelines

🔗Internal Links:

Best Technical Analysis Books and Tools for Financial Markets

Google Finance vs Yahoo Finance: Which Is Better for Investors?

Need Help with Your Money? Choose the Right Financial Expert